nevada estate tax exemption 2021

This exemption can be used for either their vehicle registration Governmental Service Tax Fee or to reduce their property taxes. The exemption amount will vary each year depending on the Consumer Price Index and the tax rates throughout the County.

Nevada Tax Advantages And Benefits Retirebetternow Com

All are adjusted for each fiscal year by adding to the amount the product of the amount multiplied by the percentage.

. The term assessed value approximates 35 of the taxable value of an item. For more information contact the Department at 775-684-2000. AUTHORITYNevada Revised Statute 3612276 assigns the Nevada Tax Commission the responsibility of establishing standards for determining the replacement cost of various kinds of personal property.

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax Credit Nevada that was collected prior to January 1 2005. Some of these include veterans disabled veterans surviving spouses blind persons and property owned. NEVADA TAX COMMISSION May 4 2020.

For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. Real PropertyVehicle Tax Exemptions Nevada Wartime Veterans Tax Exemption applies to residents who have served in the Armed Forces of the United States in any of the following branches. Ad Fill Sign Email APP-0201 More Fillable Forms Register and Subscribe Now.

I hereby request real estate tax exemption and certify the foregoing statements are true and correct to the best of my knowledge and belief. An estate tax return is due within nine months of the owners death. Get Access to the Largest Online Library of Legal Forms for Any State.

This exemption can be used for either their vehicle registrations Governmental Service Tax Fee or to reduce their property taxes. Nevada repealed its estate tax also called a pick-up tax on Jan. Ad The Leading Online Publisher of Nevada-specific Legal Documents.

Effective July 1 2021 the 2021 Legislative Session Senate Bill 440 amended NRS 3727821 and related statutes to provide an exemption from Nevada sales tax on sales of tangible personal property to certain Nevada National Guard members and their qualifying dependents living at the same physical address in Nevada. HOUSING COSTS PAID - JANU ARY 1 2021 TO DECEMBER 31 2021 Applicant s Signature Date Date. 60-79 is entitled to an exemption of 10000 assessed value.

I understand any person falsely requesting tax exemption shall be guilty of a Class 3. This exemption is not granted automatically. All property tax exemptions in Nevada are stated in assessed value amounts.

The gifting frenzy has continued through 2021 as more people have grown concerned that the 11 million exemption would drop sooner than 2026 and possibly lower than 5 million given the. Estates can apply for an automatic six-month extension though so estate tax returns for deaths in a particular year may be filed in that year or in one of 2. Through either selection veterans and surviving spouse can also donate all or a portion of their exemption to the Nevada State Veterans Homes in Boulder City and Sparks.

These standards and methods of valuation are contained in the Personal. It is one of the 38 states that does not apply an estate tax. NRS 3614723 provides a partial abatement of taxes by applying a 3 cap on the tax bill of the owners primary residence single-family house townhouse condominium or manufactured home.

Under Nevada law there are no inheritance or estate taxes. The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience. The Nevada State Legislature has passed a law to provide property tax relief to all citizens.

The Nevada Legislature provides for property tax exemptions to individuals meeting certain requirements. In 2021 the estate tax rate begins at 18 percent on the first. Nevada Revised Statute NRS 372326 provides for an exemption from SalesUse Tax for non-profit organizations created for religious charitable or educational purposes however organizations must apply for and receive approval for exempt entity status by the Department of.

Ad Download Or Email APP-0201 More Fillable Forms Register and Subscribe Now. Property tax exemption programs. The documents found below are available in at least one of three different formats Microsoft Word Excel or Adobe Acrobat PDF.

This exemption is not granted automatically. The Clark County Treasurer provides an online payment portal for you to pay your property taxes. Army Navy Marines Air Force Coast Guard the National Guard or Reserves while on active duty and the Merchant Marine during time of war or national.

Please visit this page for more information. Select the available appropriate format by clicking on the icon and following the on screen. Through either selection veterans and surviving spouse can also donate all or a portion of their exemption to the Nevada State Veterans Homes in Boulder City and Sparks.

To an exemption of 15000 assessed value. TOPICApproval of the 2021-2022 Personal Property Manual. This means that when someone dies and.

The amount of the estate tax exemption for 2022.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

List Of Senate And Assembly Bills Signed In Nevada 2021

The Key Estate Planning Developments Of 2021 Wealth Management

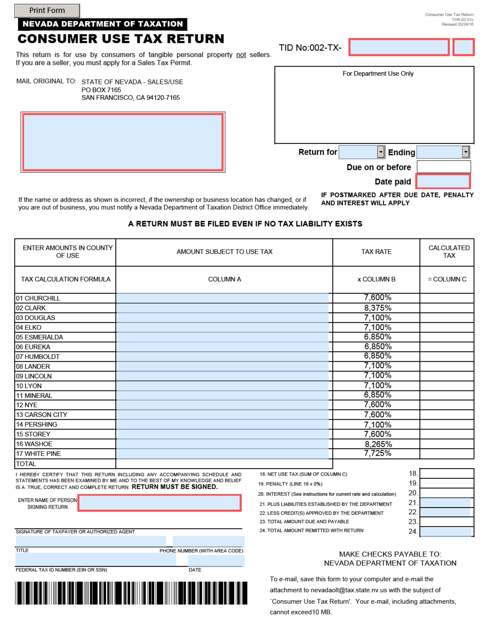

Form Txr 02 01c Download Fillable Pdf Or Fill Online Consumer Use Tax Return 2021 Nevada Templateroller

The Mad Dash Is Over For Now Grant Morris Dodds

States With An Inheritance Tax Recently Updated For 2020

The Mad Dash Is Over For Now Grant Morris Dodds

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Vs California Taxes Explained Retirebetternow Com

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Creative Estate Tax Strategies To Consider For 2021 Denha Associates Pllc

How Do State And Local Individual Income Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The State Of Estate Tax Vested Magazine Captrust

Recent Changes To Estate Tax Law What S New For 2019

What Is The Estate Tax Estate Planning Bridge Law Llp

States With No Estate Tax Or Inheritance Tax Plan Where You Die

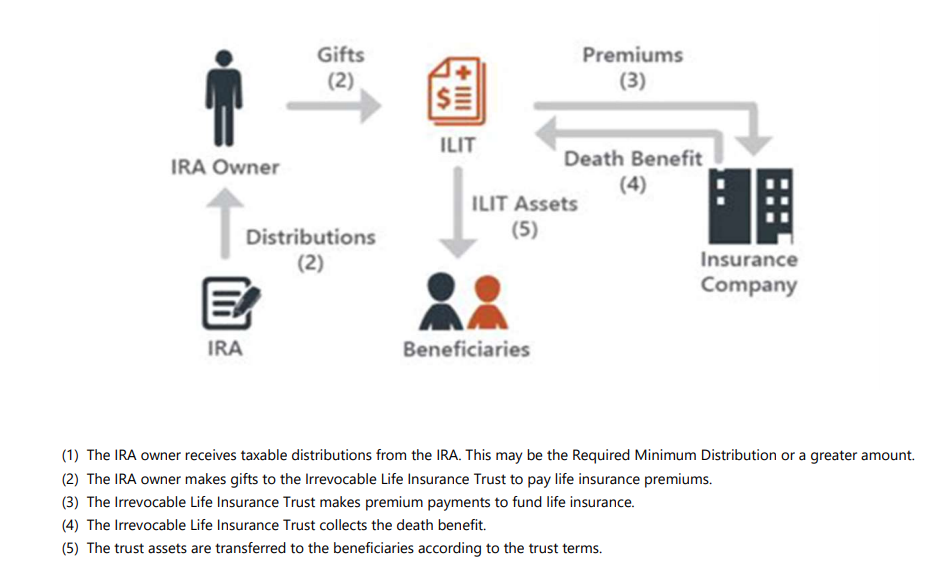

Saving State Income Taxes Ning Trusts And Completed Gift Non Grantor Options Ultimate Estate Planner